Funeral planning can be overwhelming, but finding the best funeral plan for you is crucial. In this article, we will explore important factors to consider, including burial insurance and coverage needs. We’ll also address common questions about funeral expenses and policies, providing recommendations and insights along the way. Join us as we navigate the world of funeral planning to ensure you make informed decisions during this challenging time.

Understanding Funeral Expenses

Funerals can be significant financial responsibilities that require careful planning to manage effectively. Understanding the various expenses associated with funerals is crucial for making informed decisions and avoiding unnecessary financial strain.

1. Funeral Service Costs: Funeral services typically involve various components, including the funeral home’s basic service fee, transportation of the body, embalming and preparation, use of facilities for visitation and ceremonies, and the casket or urn.

2. Cemetery Fees: If burial is preferred, cemetery expenses can include the cost of the plot, grave digging, headstone or marker, and perpetual care fees.

3. Cremation Expenses: Opting for cremation involves costs such as the crematory fee, container or urn, and optional services like memorial ceremonies or scattering of ashes.

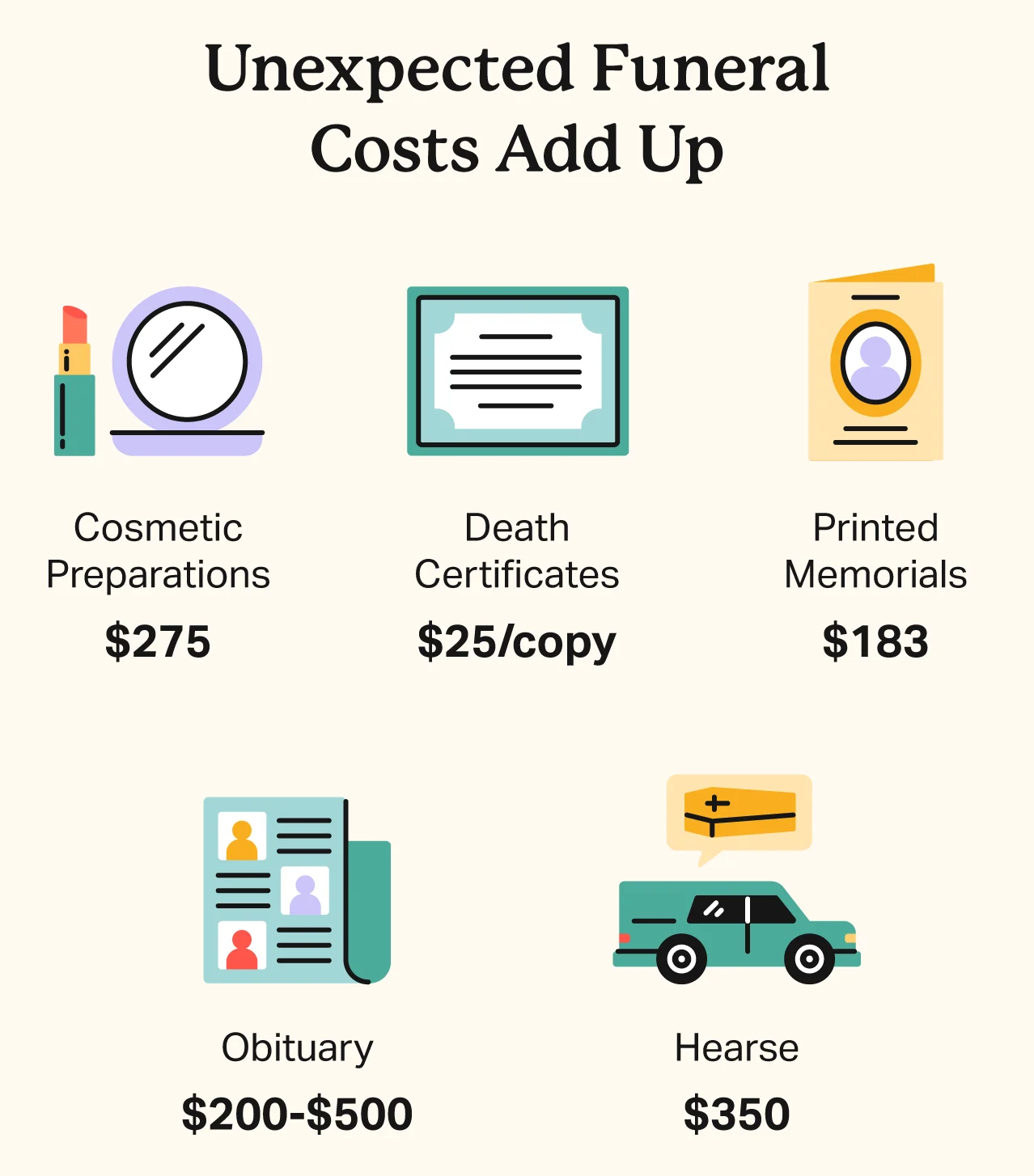

4. Additional Costs: Additional expenses can arise from factors such as obituary notices, floral arrangements, transportation for family and guests, and catering for post-funeral gatherings.

It’s essential to consider the different elements of funeral expenses and evaluate how they align with your budget and preferences. By understanding these costs, you can make informed decisions and potentially save money by choosing appropriate funeral plans and services.

Factors to Consider When Choosing a Funeral Plan

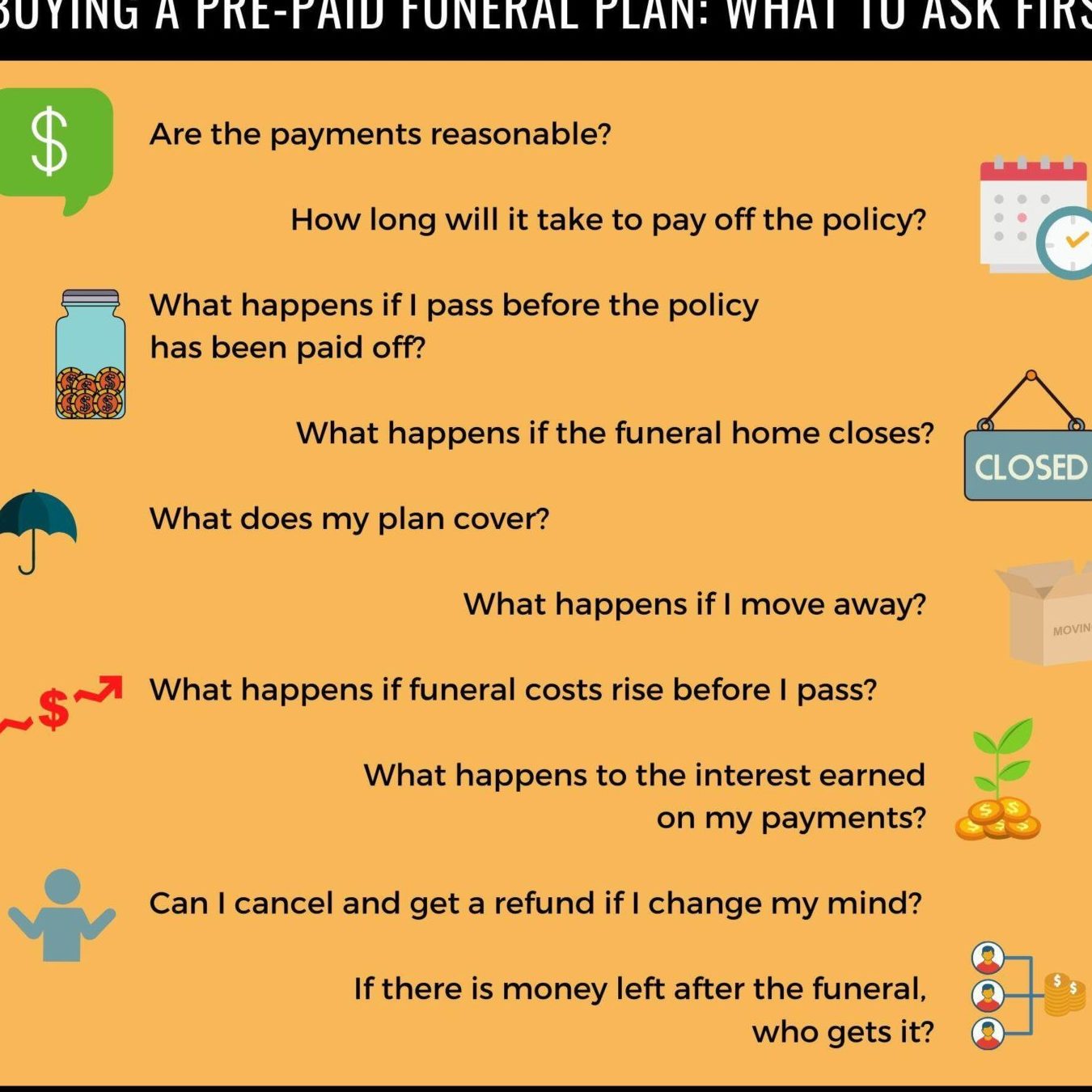

When it comes to choosing a funeral plan, there are several important factors to consider. Making the right decision will ensure that your final wishes are honored and that the financial burden on your loved ones is minimized. Here are key factors to keep in mind:

- Cost: Funeral expenses can vary widely, so it’s crucial to consider your budget and choose a plan that aligns with your financial capabilities. While affordability is important, it’s also vital to balance cost with the level of service and coverage provided.

- Type of Plan: Funeral plans come in different forms, such as pre-need funeral insurance, prepaid funeral plans, and final expense insurance. Understanding the differences between these options will help you determine which one suits your needs best.

- Coverage: Consider the coverage offered by different plans. Evaluate if it includes funeral services, transportation, burial or cremation costs, and other related expenses. Ensure that the plan sufficiently covers your desired arrangements.

- Flexibility: Look for a plan that allows for flexibility in making changes or modifications to your funeral arrangements. Life is unpredictable, and having the ability to update your plan as needed can provide peace of mind.

- Provider Reputation: Research and select a reputable funeral plan provider. Read customer reviews and testimonials to gauge their professionalism, reliability, and commitment to customer satisfaction.

- Add-Ons or Customization: Some plans offer additional services or customization options, such as music choices, memorial tributes, or specific cultural or religious rituals. If these elements are important to you, ensure that the plan allows for personalization.

By carefully considering these factors, you can make an informed decision and choose a funeral plan that suits your needs, preferences, and budget. Remember to review and compare multiple options before finalizing your choice, as selecting the best funeral plan requires thoughtful consideration and planning.

The Importance of Burial Insurance

When considering funeral planning, one crucial aspect to keep in mind is the importance of burial insurance. This type of insurance provides coverage specifically for funeral expenses, ensuring that your loved ones are not burdened with financial responsibilities during an already difficult time.

Burial insurance serves as a safety net, offering peace of mind knowing that your final arrangements will be taken care of. With the rising costs of funerals, having adequate coverage is essential to prevent your family from facing significant financial strain.

One of the key advantages of burial insurance is its specific focus on funeral-related expenses. Traditional life insurance policies may not provide sufficient coverage for funeral costs, leaving your family to find alternative means to cover the expenses. With burial insurance, you can customize your policy to suit your needs and ensure that all funeral-related expenses, such as caskets, burial plots, flowers, and memorial services, are adequately covered.

Moreover, burial insurance typically offers a simplified application process, making it easily accessible to individuals of various ages and health statuses. Some policies may not even require a medical exam or have stringent health restrictions, allowing more individuals to secure coverage for their end-of-life expenses.

Additionally, burial insurance policies often provide quick payout structures, ensuring that funds are available to cover funeral expenses promptly. This streamlines the process and alleviates any financial burdens on your loved ones during an already emotionally challenging period.

In conclusion, burial insurance is a crucial component of developing the best funeral plan for you. It offers specific coverage tailored to funeral expenses, provides peace of mind, and ensures that your loved ones are not left with the financial burden of your final arrangements. By considering burial insurance as part of your funeral planning, you can rest assured knowing that your funeral expenses will be taken care of, allowing your family to focus on grieving and honoring your memory.

Comparing Burial Insurance and Life Insurance

When planning for your funeral, it’s important to understand the differences between burial insurance and life insurance. While both types of policies provide financial coverage in the event of your death, they serve different purposes and have distinct features.

Burial Insurance:

- Burial insurance, also known as final expense insurance, is specifically designed to cover funeral costs and related expenses.

- It offers a smaller coverage amount compared to life insurance policies, typically ranging from $5,000 to $25,000.

- The premiums for burial insurance are generally more affordable, making it an accessible option for individuals on a limited budget.

- Unlike life insurance, burial insurance policies often have simplified underwriting processes, meaning there might not be a medical exam or extensive health questions required.

- The death benefit from burial insurance is usually paid out quickly, allowing families to cover immediate funeral expenses without delay.

Life Insurance:

- Life insurance provides coverage for a broader range of financial needs, including funeral expenses, mortgage payments, education costs, and income replacement for beneficiaries.

- It offers higher coverage amounts, which can range from a few hundred thousand dollars to several million.

- Life insurance policies require more comprehensive underwriting, including medical exams and detailed health questionnaires.

- The premiums for life insurance are generally higher due to the increased coverage and additional benefits it offers.

- While burial insurance primarily focuses on funeral expenses, life insurance provides financial security for the long-term needs of your loved ones.

When deciding between burial insurance and life insurance, it’s essential to evaluate your specific requirements and financial situation. If your primary concern is covering funeral costs and ensuring your loved ones can manage immediate expenses, burial insurance may be the more suitable option. However, if you have broader financial obligations and want to provide a higher level of financial security for your beneficiaries, a life insurance policy may be the better choice.

Determining Your Funeral Plan Coverage Needs

When determining your funeral plan coverage needs, it’s essential to consider various factors that can impact the overall expenses. By understanding these factors, you can ensure that you choose the best funeral plan that suits your specific requirements.

Your Financial Situation: Evaluate your financial situation, including your income, savings, and any existing insurance policies. This assessment will help determine how much coverage you can afford and whether you need additional funeral insurance.

Funeral Costs: Research and gather information about typical funeral costs in your area. Factor in expenses such as casket, burial plot, funeral service, transportation, and memorial arrangements. Consider any cultural or religious traditions that may add to the overall costs.

End-of-Life Wishes: Take into account your specific end-of-life wishes and preferences. Do you prefer a traditional burial or cremation? Are there any specific funeral services or ceremonies you would like to include? Understanding your preferences will help determine the level of coverage you need.

Family Considerations: Consider the needs and expectations of your immediate family. Will they be financially burdened by your funeral expenses? Assess whether you want to provide financial protection for your loved ones or ensure they have access to necessary funds during a difficult time.

Key Points to Remember:

- Evaluate your financial situation to determine how much coverage you can afford.

- Research and consider the typical costs associated with funerals in your area.

- Take your end-of-life wishes and preferences into account.

- Consider the needs and expectations of your immediate family.

By considering these factors, you will be better equipped to determine your funeral plan coverage needs. Remember, choosing the right funeral plan is a personal decision that should align with your financial situation, preferences, and the well-being of your loved ones.

Addressing Common Questions about Funeral Planning

What is the Average Cost of a Funeral?

The average cost of a funeral in the United States can vary significantly depending on various factors, such as the location, type of service, and additional expenses. As of 2023, the average cost ranges from $7,000 to $12,000. However, it’s important to keep in mind that these costs can increase with additional services or customization.

Can You Qualify for Burial Insurance with Pre-Existing Conditions?

Yes, it is possible to qualify for burial insurance even if you have pre-existing conditions. Unlike traditional life insurance, burial insurance typically has more lenient underwriting requirements, making it accessible to individuals with health issues. However, certain conditions may affect the coverage amount or premium rates.

How Much Coverage Do You Need?

Determining the appropriate coverage amount for burial insurance depends on various factors such as personal preferences, funeral expenses, outstanding debts, and desired financial protection for loved ones. It’s recommended to assess these aspects and consult with an insurance professional to determine the ideal coverage amount for your specific needs.

How Does Burial Insurance Work?

Burial insurance, also known as final expense insurance, is a type of life insurance designed to cover funeral and burial expenses. It works by providing a death benefit to the beneficiaries upon the insured individual’s passing. The funds can be used to cover funeral costs, cemetery fees, and other related expenses.

What is the Application Process Like?

The application process for burial insurance is typically straightforward and less stringent compared to traditional life insurance. It involves filling out an application form, answering health-related questions, and sometimes undergoing a simplified underwriting process. In many cases, no medical exam is required, making it a convenient option for individuals who may have difficulty qualifying for other types of insurance.

What Happens If You Pass Away During the Waiting Period?

During the waiting period, which is a common feature of burial insurance policies, the full death benefit may not be payable. Instead, the policy may only provide a portion of the benefit or a refund of the premiums paid. The specific terms and conditions vary among insurance providers, so it’s crucial to review the policy details thoroughly.

Can You Change Your Burial Insurance Policy?

Most burial insurance policies offer flexibility and allow policyholders to make changes to their coverage. This may include increasing or decreasing the coverage amount, updating beneficiaries, or adjusting the policy provisions. It’s advisable to review your policy periodically and consult with your insurance provider to make any necessary changes to align with your evolving needs. Este es el texto en formato HTML correspondiente a la sección ‘7. Addressing Common Questions about Funeral Planning’ del artículo sobre ‘What is the Best Funeral Plan for You’. He seguido todas las indicaciones específicas dadas.

Final Thoughts and Recommendations for Your Funeral Plan

Planning for your funeral can be a daunting task, but it is an important step in ensuring that your final wishes are respected and that your loved ones are not burdened with hefty expenses during their time of grief.

As you consider the best funeral plan for you, there are a few key factors to keep in mind. First, take the time to understand the various funeral expenses that may arise. From funeral service fees to the cost of caskets or urns, having a clear understanding of these expenses will help you make informed decisions.

Another important consideration is burial insurance. This insurance coverage can provide financial protection specifically for funeral costs, alleviating the burden on your loved ones. Take the time to research reputable burial insurance companies that offer suitable coverage options.

When comparing burial insurance and life insurance, it’s important to evaluate the specific benefits and limitations of each policy. Burial insurance typically offers smaller benefit amounts compared to life insurance but may have more lenient qualification requirements.

In determining your funeral plan coverage needs, assess your personal situation and preferences. Consider factors such as your desired funeral type, location, and any specific cultural or religious requirements. This will help you tailor your funeral plan to align with your wishes.

Addressing common questions about funeral planning can also provide clarity and guidance. Understand the average cost of a funeral, the qualification process for burial insurance, the coverage amount you need, and the application process. Additionally, be aware of the implications of the waiting period and whether you have the flexibility to change your burial insurance policy if needed.

In conclusion, taking the time to carefully consider your funeral plan is a thoughtful and responsible decision. By understanding funeral expenses, exploring burial insurance options, and addressing common questions, you can make informed choices that provide peace of mind for yourself and your loved ones.

Mistakes in Planning a Funeral: Avoid These Common Errors in Funeral Planning

Effective Strategies for Family Preplanning Discussions

Funeral Planning as an Act of Love: Securing Your Loved Ones’ Future

Key Questions to Ask When Choosing a Funeral Plan in the US

How to Finance Your Funeral Plan: Options and Tips for US Residents

Benefits of Funeral Preplanning

The Importance of Preplanning Your Funeral

How to Plan a Funeral in 7 Steps: A Comprehensive Guide for Americans