When it comes to funding your funeral plan, understanding the available options and tips is crucial. This article provides concise information on funeral funding options, including insurance policies and prepaid plans. It also offers advice on making smart financial decisions, avoiding fraud, and exploring assistance programs. Additionally, it addresses common FAQs about funeral costs and insurance usage. Read on to empower yourself with the knowledge needed to make informed decisions regarding your funeral plan.

Funeral Funding Options

Insurance Companies and Policies

One way to fund your funeral plan is through insurance companies and policies. Many insurance providers offer specific plans designed to cover funeral expenses. These policies provide a payout that can be used to finance various aspects of a funeral, including burial or cremation costs, funeral services, and even memorial expenses.

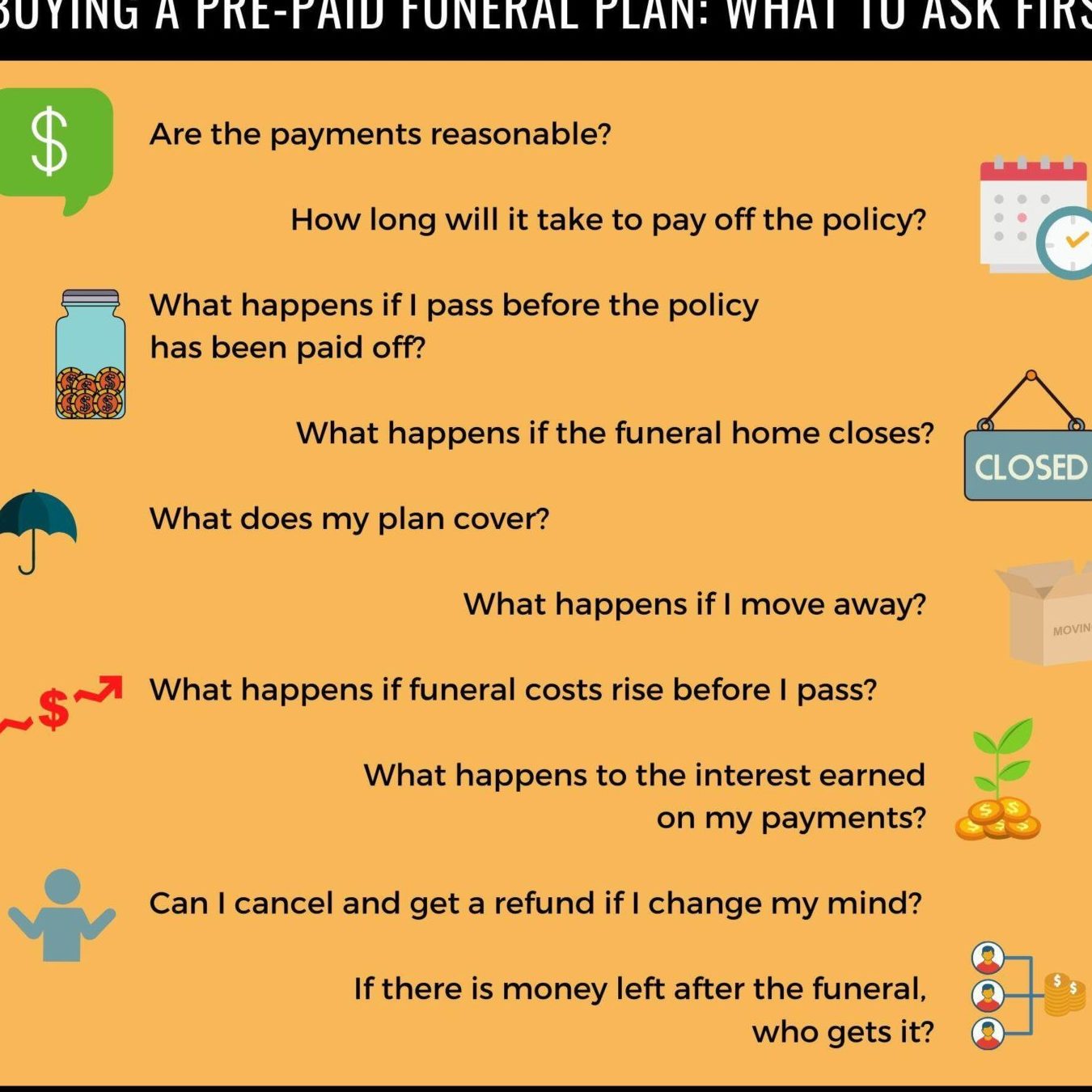

Prepaid Funeral Plans

Prepaid funeral plans allow you to pay in advance for your funeral expenses. These plans typically involve working with a funeral home to outline your preferences and make financial arrangements. By paying for your funeral in advance, you can relieve your loved ones of the burden of managing the costs and decisions during an emotionally challenging time.

Final Expense Insurance

Final expense insurance, also known as burial or funeral insurance, is a specific type of policy designed to cover funeral and burial costs. This insurance can provide a lump-sum payment to your designated beneficiaries upon your passing, which can then be used to cover various funeral expenses. Final expense insurance offers a straightforward way to ensure that your funeral expenses are taken care of and prevent any financial strain on your family.

By exploring these funeral funding options – insurance companies and policies, prepaid funeral plans, and final expense insurance – you can take proactive steps to financially prepare for your funeral and provide peace of mind for yourself and your loved ones.

Choosing the Right Funeral Plan

Evaluating Funeral Costs

When choosing a funeral plan, it is crucial to carefully evaluate the associated costs. Consider aspects such as funeral home fees, transportation expenses, cemetery fees, and burial or cremation costs. Research and compare prices from different providers to ensure you make an informed decision.

Planning Funeral Arrangements

Planning funeral arrangements involves making decisions about the ceremony, viewing, service, and final resting place. Consider the preferences and wishes of your loved one, religious or cultural requirements, and any personalization you may desire. Communicate with the funeral home to organize the details accordingly.

Considering Burial vs. Cremation

One crucial decision when choosing a funeral plan is whether to opt for burial or cremation. Understand the differences, costs, and personal preferences associated with each option. Consider factors such as cultural traditions, environmental concerns, and the availability of suitable resting places.

Funeral Home Services and Benefits

When selecting a funeral plan, take into account the services and benefits offered by different funeral homes. These may include professional guidance and support, embalming, visitation arrangements, transportation assistance, grief counseling, and aftercare programs. Understand what options each funeral home provides to suit your needs.

Tips for Smart Financial Decision-Making

Avoiding Funeral Fraud

Protect yourself and your family from potential funeral fraud by staying informed and vigilant. Research funeral service providers thoroughly, checking their reputation and credentials. Be cautious of unsolicited offers or high-pressure sales tactics. Verify the terms and conditions of any contracts or insurance policies before signing. If something seems too good to be true, it probably is. Report any suspicious activity to the appropriate authorities.

Maximizing Social Security Benefits

Understanding how Social Security benefits can contribute to funding your funeral plan is crucial. Familiarize yourself with the eligibility criteria and available options, such as the lump-sum death payment or survivor’s benefits. Consider consulting with a financial advisor to help you navigate the complexities of Social Security and maximize the benefits you are entitled to receive.

Exploring Financial Assistance Programs

If you are facing financial constraints when funding your funeral plan, explore various financial assistance programs. These programs may provide grants or low-interest loans specifically designed to cover funeral expenses. Research local, state, and federal initiatives, as well as charitable organizations that offer support in times of need. Be sure to understand the eligibility requirements and application process for each assistance program.

Planning Ahead for Your Loved Ones

Planning ahead for your funeral not only ensures your wishes are met but also relieves your loved ones of the burden of making financial decisions during a difficult time. Consider establishing a savings account or funeral trust to cover future costs. Communicate your plans to family members and ensure they have access to essential documents and information. By planning ahead, you provide peace of mind and financial stability to those you care about.

Funeral Funding FAQs

Here are some frequently asked questions regarding funeral funding:

How much does a funeral cost?

The cost of a funeral can vary depending on factors such as location, type of service, and additional services selected. On average, a traditional funeral can range from $7,000 to $12,000, while a cremation service can cost between $3,000 and $7,000.

Can you use life insurance to pay for funeral expenses?

Yes, life insurance can be used to cover funeral costs. It’s important to check the terms of the policy to ensure that funeral expenses are covered. Some life insurance policies specifically include a provision for funeral expenses, while others may require a designated beneficiary or the assignment of funds for funeral costs.

What are the benefits of prepaid funeral plans?

Prepaid funeral plans offer several advantages. By prepaying for your funeral, you can alleviate the financial burden on your loved ones. It also allows you to plan and personalize your funeral according to your wishes, ensuring that your preferences are carried out.

How to find the best funeral home and burial insurance?

When searching for a funeral home and burial insurance, consider factors such as reputation, services provided, pricing transparency, and customer reviews. Research and compare multiple options to find the best fit for your needs. Additionally, consult with a trusted financial advisor to ensure you make an informed decision.

Do funeral homes offer financial assistance options?

Some funeral homes may offer financial assistance programs or have arrangements with financing companies. It’s advisable to inquire about any available options when making funeral arrangements. Additionally, exploring government assistance programs and organizations that provide financial support for funerals can be helpful.

By understanding the answers to these frequently asked questions, you can make informed decisions when it comes to funding your funeral plan.

Mistakes in Planning a Funeral: Avoid These Common Errors in Funeral Planning

What is the Best Funeral Plan for You: A Comprehensive Guide for US Residents

Effective Strategies for Family Preplanning Discussions

Funeral Planning as an Act of Love: Securing Your Loved Ones’ Future

Key Questions to Ask When Choosing a Funeral Plan in the US

Benefits of Funeral Preplanning

The Importance of Preplanning Your Funeral

How to Plan a Funeral in 7 Steps: A Comprehensive Guide for Americans